Main Content

Rent To Own Homes in AZ Free Listings

Are you looking for a rent to own home in Arizona? If so, you’ve come to the right place. We have free listings of rent to own and lease purchase homes in AZ.

Rent to own is a great way to get into a home without having to put down a huge down payment. Bad credit or no credit is not an issue with a rent to own homes in AZ.

Featured Rent To Own Homes AZ Free Listings

Rent To Own Homes in AZ

There are many rent to own homes in AZ. Let’s narrow down your search.

Browse our rent to own free listings to see what’s available.

You can also view our featured listings, which are homes that have been handpicked by our team as the best of the best in Arizona.

If you don’t find a property that you like, check back often because we add new homes all the time. To start, please choose your preferred city.

Arizona Cities with Rent to Own Homes

Arizona Counties Rent To Own Homes

Rent To Own or Buy A House in AZ?

If you’re looking to buy a home in Arizona, it’s important for you to know what type of financing options are available and how they work. The first step is determining what kind of loan will fit your needs best: a conventional loan, an FHA loan or a VA loan.

These three types of loans all have their advantages and disadvantages, but they’re also similar in many ways. For example, they all require down payments and monthly mortgage payments that cover the cost of your home’s principle balance (the amount you borrowed to buy it), interest rate fees and property taxes.

While you won’t be able to buy a house in AZ with bad credit, there are other ways to get approved. You can purchase a home with a rent-to-own agreement, which allows you to live in the property while also paying rent on it. This helps you build your credit history and shows that you’re responsible enough to make payments on time.

If you’re a first-time homebuyer, you’ll likely be looking for homes for sale with a low price point. Some areas in Arizona can get quite expensive, but there are plenty of affordable options available. If you want to buy a house in AZ and don’t have the funds for your down payment yet, consider starting out by renting to own.

Rent To Own Homes in AZ – How Does It Work?

A rent-to-own home is typically offered by a seller who wants to sell their property but doesn’t have the funds for their down payment.

The seller will enter into an agreement with you that allows you to lease the property and pay rent as normal.

You then have the option of purchasing it at some point in the future by putting down a larger deposit than usual – often 25% of what it would cost if you bought it outright.

Why Rent To Own In AZ?

There are many benefits to rent to own homes in Arizona. If you’re looking for a new place to live and don’t want to pay full price up front, a rent-to-own agreement is perfect. You can make small monthly payments while still living in the home, which gives you time to get used to it.

If you like the place, you’ll have the option to buy it later on. If you don’t like it, or if something goes wrong with the home or rental agreement, there are no strings attached and you can move out at any time.

Check out all Free Rent To Own Listings Available.

Rent To Own Homes in NC Free Listings

Rent to own homes in NC can be a great option for those who are looking to own their own home but have little or no credit history. Browse our North Carolina free rent to own listings to find your new home.

Rent to own homes are a good way to get your foot in the door of homeownership and build up your credit score while saving money. You can rent-to-own a house in North Carolina with as little as $500 down payment, and pay off the rest of the purchase price over time.

Featured Rent To Own Homes NC Free Listings

Rent To Own Homes in NC

There are many rent to own homes in NC. Let’s narrow down your search. Browse our rent to own free listings to see what’s available. You can also view our featured listings, which are homes that have been handpicked by our team as the best of the best in North Carolina. If you don’t find a property that you like, check back often because we add new homes all the time. To start, please choose your preferred city.

North Carolina Cities with Rent to Own Homes

North Carolina Counties Rent To Own Homes

If you’re looking for rent-to-own homes in North Carolina, there are several counties that have a high number of these properties available. The most popular counties for rent-to-own homes include: Mecklenburg County

Mecklenburg County has the highest number of rent to own properties in North Carolina. There are more than 1,000 homes available.

Here are some of the best rent-to-own opportunities in Pennsylvania:

Rent To Own or Buy A House in NC?

If you’re looking to buy a home in North Carolina, there are many different options available. You can choose from traditional mortgages or rent to own homes. It’s important to consider your financial situation and long-term goals before making a final decision.

If you are interested in a traditional mortgage, it will be important to research your credit score and determine if you have enough cash for a down payment. If not, there are other options available including FHA loans and VA mortgages which require smaller down payments.

If you’re looking to buy a home without a mortgage, then rent-to-own homes are the perfect alternative. They offer the opportunity to live in your own home without making monthly mortgage payments.

In addition to being an affordable option for home buyers, rent to own homes in North Carolina can also be a good way to get into the market without having a large down payment. The average cost of buying a house in 2021 is $300,000 nationwide, with the median price being $238,600.

Rent To Own Homes in NC – How Does It Work?

The rent-to-own process can vary from place to place, but in general it involves renting a home for a certain period of time and then purchasing the property at an agreed upon price. This type of housing is often used by those who are unable to qualify for traditional financing due to poor credit or limited income. When you rent-to-own, you typically pay more than what your monthly mortgage would be if you were buying the home normally.

The rent-to-own process is also ideal for those who want to live in a home they like but don’t have the money to purchase it outright. Rent-to-own agreements are typically structured as lease-options, which give you the right (but not obligation) to buy the property later down the road if you so choose.

Why Rent To Own In NC?

There are a few reasons why rent to own is becoming popular in the state of North Carolina. For one, it allows you to take advantage of rising home prices without having to come up with a down payment and other closing costs. It’s also an option for those who may not be able to qualify for traditional financing due to poor credit or limited income.

In addition, rent to own allows you to test out a neighborhood and see if it’s somewhere you want to live. If so, you can purchase the home later on down the line if you choose.

Check all properties from rent to own homes free listings.

Rent To Own Homes Pennsylvania Free Listings

Rent to own homes are great for many reasons. Renting a home before purchasing it can give you the chance to find out if you and your family will like living in that area. Renting to own also allows you to get comfortable with your neighbors, schools, and community.

If you’re looking for rent to own homes in Pennsylvania, we’ve got the free listings! Check out all the rent to own homes in Pennsylvania below and find the one that’s right for you and your family.

Featured Rent To Own Homes PA Free Listings

Rent To Own Homes in PA

There are many rent to own homes in PA. Let’s narrow down your search. Browse our Pennsylvania free rent to own listings to see what’s available. You can also view our featured listings, which are homes that have been handpicked by our team as the best of the best in Pennsylvania. If you don’t find a property that you like, check back often because we add new homes all the time. To start, please choose your preferred city.

Pennsylvania Cities with Rent to Own Homes

Pennsylvania Counties Rent To Own Homes

Rent to own homes in Pennsylvania represent a unique opportunity for buyers who don’t want to put down a large amount of money up front, but do want to buy a house. In many cases, you’ll get the chance to move into your new home before you actually purchase it. This can be especially helpful if you need more time to save up for a down payment or get approved for financing. Here are some of the best rent-to-own opportunities in Pennsylvania:

Rent To Own Or Buy A House In Pennsylvania?

Rent to own homes in Pennsylvania are available. These homes are also known as lease-to-own homes and rent-to-own homes. If you want to buy a house, but don’t have the money yet, then rent to own may be a good option. You can rent the house in order to get credit history and build up your credit score at the same time as saving money for a down payment on your future home purchase.

If you’re looking for a rental property that will allow you to buy it at some point in the future, then you’ll need to make sure that there is an option for this kind of purchase available from your landlord or property management company. This type of deal is usually called “rent with option to purchase.”

Rent To Own Homes in PA – How Does It Work?

The rent to own process works like any other sale where an investor is selling an asset at an agreed upon price with some added conditions attached. In this case, the buyer agrees to make monthly payments on an asset such as a house or condominium unit until they reach a predetermined date when they can buy it outright. This is usually referred to as the “closing date” because it’s when all the paperwork is signed and the payment made to finalize the sale.

Why Rent To Own In Pennsylvania?

Pennsylvania is one of the most affordable states in the country, with an average home value of approximately $133,000. With an average household income of $56,000 and a median age of 40 years old, there is a large population base that qualifies for homeownership.

The state also has a healthy real estate market, with an average home price appreciation of 4.3 percent in 2022. If you’re looking to invest in real estate or simply want to own your own home, rent-to-own is a great way to make this happen!

Rent-to-own homes are often more affordable than traditional rentals because you don’t have the added expense of property taxes and maintenance fees.

How does Rent To Own work

Tired of living in short term housing? Maybe it is time for you to get out of the rut you find yourself entrapped in as you move from one short term housing option another. If you are like me then you have had ample opportunity to explore the short term housing market. Yet you are still not satisfied with the options available to you. Your true desire is to own a home but it just doesn’t seem feasible right now.

If this describes your situation then maybe it is time you consider the rent to own approach. The rent to own option provides a viable substitute to living in short term housing. Some of the obvious obstacles to leaving the short term housing scene and moving into your own house are insufficient credit or unstable finances. When you rent to own you can avoid some of these obstacles.

How Rent to Own Works

When you agree to a rent to own contract you are essentially agreeing to live in a dwelling for the stated period of time. Part of the agreement includes the monthly rental payments that you must make to retain the rights to live in the dwelling. However, at the end of the contract the renter then has the option to actually purchase the dwelling from the owner. This part of the rent to own agreement is often referred to as a lease option because it grants you the option to buy the house when the term of the contract has run its course.

By structuring the legal relationship in this manner, the renter is able to live in an affordable rental which facilitates saving up for a down payment on the home in the future. This helps the renter live in a dwelling that offers ample space and fits their needs as well as buys them time to turn around their financial instability so that they can eventually buy the house. As the renter is improving his financial position they will also be able to improve their credit rating which will help them secure financing for the house in the future.

Browse our Rent to own homes Free Listings

The rent to own option can also prove beneficial because it allows you ample time to decide if you really like the house or not. There is no substitute for actually living in and experiencing the advantages and disadvantages that a house presents. Think of it like a trial period that allows you to try before you buy.

As you live in a rent to own property you will also find the extra space that rent to own dwellings offer extremely beneficial. As you well know, short term housing is often too cozy and cramped so the extra space will be welcomed by your family.

So before you move into the next short term housing dwelling that is bound to lose its appeal and result in yet another move, consider the rent to own option. Even if you have bad credit or your financials are not as strong as you would like them to be, living in a rent to own dwelling might be just the solution you have been looking for.

Rent To Own Homes – Good Alternative

Rent To Own Homes – An Alternative For People With Less Than Perfect Credit

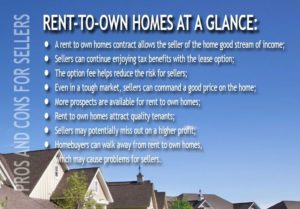

How does rent to own work – For many people, purchasing a property or home will be one of the biggest investments that they ever make. Because of this, a lot of time should be put into doing research so that they can make the most out of their money. In this article, we are going to talk about why rent to own homes can benefit both buyers and sellers.

How does rent to own work – For many people, purchasing a property or home will be one of the biggest investments that they ever make. Because of this, a lot of time should be put into doing research so that they can make the most out of their money. In this article, we are going to talk about why rent to own homes can benefit both buyers and sellers.

To purchase a home with traditional financing, there are many hoops buyers need to jump through to qualify for funding from a bank. A credit check is performed, income verification is done, bank statements checked, tax returns provided, pay stubs collected, etc. This is done to ensure the buyer purchasing the home as rent to own will be able to make the monthly payments and is not overreaching of monthly payment they are committing themselves to. But what if the buyer fails to qualify? What can they do but wait while they work to make improvements in the deficient areas?

One option buyers with less than perfect credit have to try purchase a home through a process referred to as rent to owning a home. They may still have all the credit checks performed, income verified, bank statements checked, tax returns provided, pay stubs collected, etc. But they could get set up with a credit repair specialist, and with that responsible step prove to a motivated seller they are on the right path to qualifying to get a home mortgage. When you rent to have home, negotiation goes on between the buyer and the seller – and does not need third party approval. Free listings rent to own .

Rent to own homes – buyers and sellers options

Rent to own home is a popular option for buyers who want to live in the home they are purchasing, but don’t have the money for a down payment. In most cases, the seller will require that the buyer purchase homeowners insurance and pay at least one month’s rent as a deposit.

The buyer will then make monthly payments until he or she has paid off the lender’s mortgage. At that point, the buyer has gained ownership of the home and can make any changes he or she wishes to make.

Sellers who wish to sell their homes through a rent-to-own agreement may be more likely to accept offers from buyers who don’t have enough cash for a down payment than those who do. These owners may also be more flexible when it comes to negotiations on price and terms of sale.

The buyer will be responsible for paying the rent and all other bills associated with the home. This includes utilities, maintenance and repairs, as well as any other expenses that may arise during his or her tenancy.

To encourage on-time payments, the option fee that was to be credited with each monthly payment in rent to own real estate is only credited with on-time monthly payments. Just because of a late payment the buyer does not get a reduction in rent since they will not receive credit. The full monthly payment is due, but with the penalty of not receiving the monthly option credit.

There is a concern that the seller will continue to make payment on obligations they have on the property from free rent to own listing, such as a mortgage payment, tax bills, sewer and trash payments, home owner association dues, etc. That is why it would be best for the seller to make payment to an escrow agent who then disperses the money to the mortgage company, local taxing authorities, sewer, and trash, home owners association, etc. to ensure that any debt obligations on the property are paid. Also of great importance and often overlooked is this escrow agent also helps build the buyers credit with proof of on time payment in the lease to own homes process.

There is still of possibility that, at the period of the sales agreement period, the buyer may still not be able to purchase the home from the given rent to own home free listings due to a variety of reasons – bad credit, not enough funds, etc. In this case, it would simply be turned back over to the original seller. This could very well have been avoided if from day one the buyer began credit repair to ensure their success in home ownership.

Rent to own homes – How it works

Rent to own homes process options

If you are looking for a home to rent and purchase, you may have come across the term “rent to own.” This means that a seller is willing to rent out a home to you for a period of time as long as you agree to buy the house at the end of this time period. You can also rent-to-own with no purchase option if you prefer.

Rent-to-Own Homes Are Usually Less Expensive Than Buying

Rent-to-own homes are usually less expensive than buying outright because they allow people who do not have enough money saved up for a down payment or closing costs to get into their own house sooner rather than later. The seller gets regular payments on their mortgage and so does not have to worry about foreclosure or selling their home later at a loss.

The Rent To Own Process Is Very Similar To A Lease Option Agreement

The process is very similar to a lease option agreement in that both parties enter into an agreement whereby one party agrees to pay rent on premises owned by another party, who then agrees not only to continue renting the premises but also agrees that if certain conditions are met (e.g., continued timely payment of rent) then the buyer will have the right to purchase the property at a pre-agreed price.

When the buyer is ready to purchase the home, this option payment made by the buyer are credited to the purchase price of the home. If the buyer decides to not purchase the home in rent to own properties, all of the option money that was to be credited to the buyer stays with the seller. Option fees are sort of like an investment made by the buyer. If they decide not to purchase the property, they lose all of the option fee money they put into a rent to own homes free listings purchase. The seller would get the home back and any option money paid up front and any option money paid with the monthly payments stays with the seller. No money is returned to the buyer.

From there, the seller could put the house back on free listings rent to own homes on the market for a traditional sale or collect another option fee down payment and try again with a new buyer, or become a landlord with a straight rental.

Ideally, the buyer would purchase the home. Typically, they can do this anytime during the length of rent to own home agreement. It could be on day one or the last day or any day in between. Until that point, though, they make a monthly payment to the seller just as they would to a mortgage company.

Rent to own homes listings for free

Rent to own real estate – free listings

Rent to own homes free listings often requires an upfront payment referred to as an “option fee.” Well here you can access our huge list for free.This is a percentage typically 3-10% of the agreed to purchase price. On a $150,000 house with a 5% option fee that would be $7500. It is also customary that a portion of each monthly payment the buyer makes to the seller goes toward the purchase of the home. This part going toward the purchase price is also referred to as option payment. This is normally 10-20% and is negotiated between the buyer and the seller.

In today’s market, rent to own real estate can be great ways for someone to own a home, when they have some negative forces working against them. They may have less than perfect credit, or may not need a large down payment. While it isn’t recommended, the buyer has an easy escape and could stop paying at any time and find somewhere else to live should they not find that location suitable or their lifestyle changes. Either way, the flexibility associated with the process has made it an attractive alternative for both buyers and sellers.

Check out our Rent to own free listings